As Home and Auto Insurance Prices Surge, WOOP Insurance, a Philadelphia Start-Up, Offers Consumers a Solution

[ad_1]

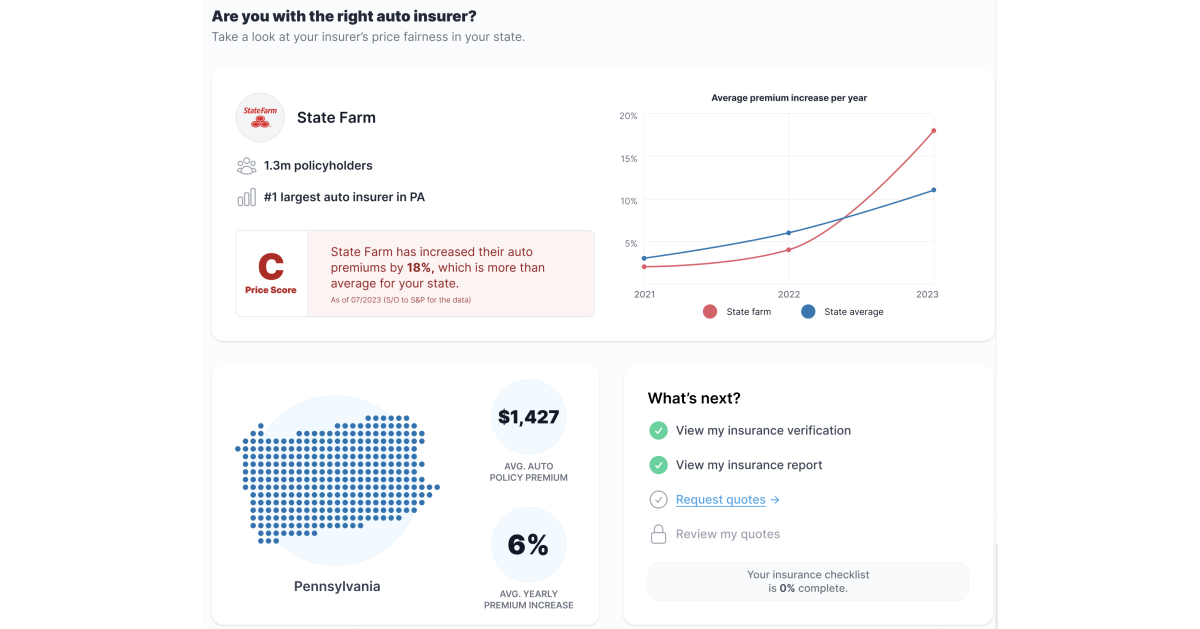

Home and auto insurance prices are rapidly rising in the current economy. Woop Insurance, a local fintech startup specializing in the insurance industry, provides consumers with a free, online evaluation of their current insurance policies, pricing, and coverage in relation to rising costs in the industry. Woop focuses on making the insurance process easy, by making pricing transparent and understandable. Woop’s Insurance Dashboard is free to use and creates a personalized report for each user that focuses on three things: if the current price they pay is fair; how their price was calculated; and if their current insurance company is raising prices faster than their competitors.

Woop Insurance CEO, Eric Foster, is a South Jersey native and a graduate of St Joe’s University – a Philadelphia Area resident, who has built a fintech company with national impact on a major industry.

After working in the insurance industry for years, Foster was driven to create a company that changed the insurance experience for consumers by providing them with price transparency, industry knowledge, and the information needed to make informed financial decisions about their policies and coverage. According to Foster: “Our mission goes beyond technology; it’s about empowering consumers.”

The Insurance Dashboard product is at the forefront of the company’s mission-driven initiatives. In response to surging insurance costs, Woop created this product to allow users to understand their own insurance policies, understand why costs are rising, and to compare their insurance options with financial savvy. Home and auto insurance are necessary costs for most Americans. By, leveraging advanced technology and data analytics, Woop’s new product aims to help users make well-informed insurance decisions, promoting financial literacy and confidence. After receiving their Insurance Dashboard report, if their current policy is not the best option, consumers can then request quotes online that compare rates and coverage from major name brand insurers, in one online experience, without calls to an insurance agent.

Foster compares the Insurance Dashboard product to a well-known tool for financial literacy for consumers: “Much like how Credit Karma demystified credit for consumers, our Insurance Dashboard seeks to do the same for insurance, making it more transparent and accessible.”

To find out more about Insurance Dashboard, our innovative insurance solutions, or Woop’s presence in the local community, contact Josh Evans, as listed above, or visit us at: https://www.woopinsuranceagency.com/.

About Woop Insurance:

Woop is redefining insurance through technology. We are committed to making insurance transparent, simple, and convenient. By demystifying the industry, we empower customers with knowledge and access to the best insurance deals in minutes.

Contact: Josh Evans

Email: [email protected]

Phone: (609) 314-1622

[ad_2]

Source link