Biometrics in Banking: Revolutionizing Security and Convenience

[ad_1]

Biometrics in Banking: Revolutionizing Security and Convenience

In the digital age, where information is readily accessible and transactions are conducted online, security and convenience remain paramount concerns for the banking industry. Traditional methods of authentication, such as PINs and passwords, are no longer considered foolproof, as cybercriminals find innovative ways to breach these barriers. To combat this, banks are turning to biometrics to revolutionize the way customers access their accounts, ensuring both heightened security and enhanced convenience.

What is Biometrics?

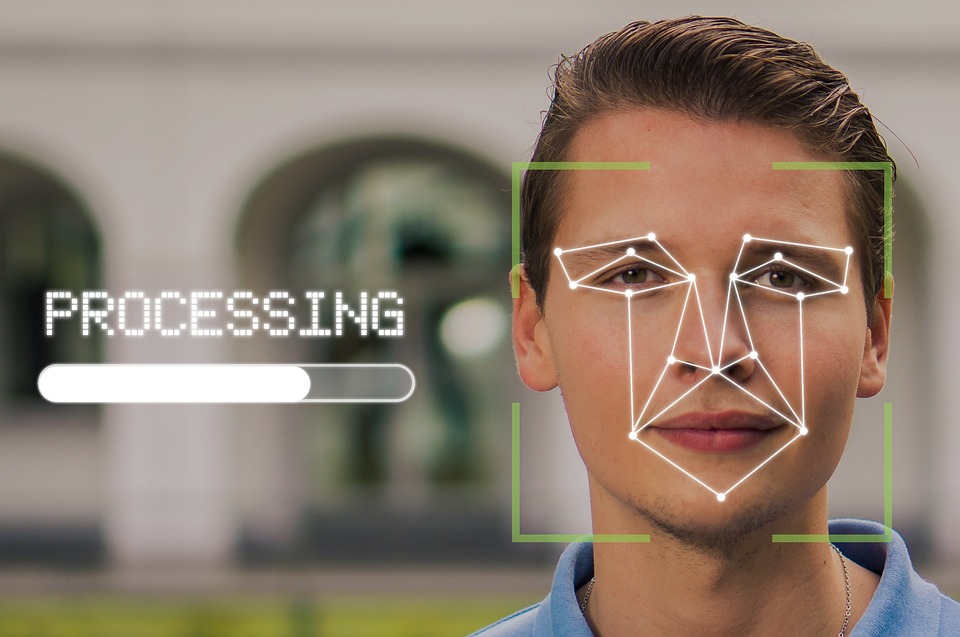

Biometrics refers to the measurement and analysis of unique physical or behavioral characteristics of an individual. It encapsulates a wide range of features, including fingerprints, facial recognition, voice pattern recognition, iris scanning, and even DNA analysis. Each individual possesses these distinct biometric identifiers, and no two people have the same set, making them an ideal method for identifying and verifying individuals.

Enhancing Security

The introduction of biometrics in banking has significantly enhanced security protocols. Traditional authentication methods rely on easily stolen information, such as passwords and personal identification numbers (PINs). Biometrics, on the other hand, cannot be easily replicated or stolen, as they are unique to each individual. This makes it extremely difficult for cybercriminals to gain unauthorized access to customer accounts.

For instance, fingerprint biometrics have been extensively used in banking applications. By utilizing advanced technology to scan and match an individual’s fingerprint, banks can ensure that only authorized users are granted access to their accounts. The likelihood of someone being able to replicate another person’s fingerprint is minimal, which drastically reduces the chances of account breaches or identity theft.

Similarly, facial recognition technology in banking has gained popularity. By analyzing and mapping facial features, banks can verify a customer’s identity in real-time. This technology also incorporates liveness detection, which ensures that a genuine, live person is present, thwarting any attempts to fool the system with an image or video.

Convenience at Your Fingertips

Apart from bolstering security, biometrics also provide unparalleled convenience for banking customers. Traditional authentication methods often require customers to memorize passwords or carry physical tokens like security keys or cards. These methods can be cumbersome and prone to human error.

Biometrics eliminate the need for customers to remember passwords or carry additional physical items. Your fingerprints or facial features are all that is required to authenticate your identity, making access to your accounts quick and hassle-free. With the widespread adoption of mobile banking apps, biometrics have further simplified the login process, allowing users to access their accounts with a simple touch or glance.

Future Potential

As biometric technology continues to evolve, it is expected to revolutionize the banking industry further. For instance, voice recognition could be used in phone banking, allowing customers to securely access their accounts by simply speaking a passphrase. Iris scanning could be integrated with ATMs, reducing the reliance on physical cards and PINs. Even DNA analysis, though currently in its early stages, may hold promise for the future in eliminating fraud entirely.

However, the adoption of biometrics does come with its own set of challenges. Privacy concerns need to be adequately addressed, ensuring that customer data remains protected and used only for verification purposes. Additionally, standardization of biometric protocols across different banking systems is necessary to ensure interoperability and a seamless customer experience.

In conclusion, biometrics in banking have revolutionized the way customers authenticate and access their accounts, providing robust security and unparalleled convenience. With ongoing advancements in technology, biometrics will continue to play a pivotal role in safeguarding customer data and facilitating seamless banking experiences.

[ad_2]